Disclaimer and Purpose of Investor Insight

Disclaimer and Purpose of Investor Insight This section of the blog gathers personal analyses and reflections on investing, written from the perspective of a science and education enthusiast. Topos Uranos offers free courses and guides in physics, mathematics, programming, finance, and philosophy. Here, we apply the same spirit of learning to explore the financial world with both rigor and curiosity. Purpose and Scope The articles...

Why Diversification Fails in Crises: Correlation, Tail Dependence, and Extreme Risk

Why Diversification Fails in Crises: Correlation, Tail Dependence, and Extreme Risk Diversification is often understood as “holding many assets”, but in quantitative finance the benefit comes from the covariance structure and, in extreme scenarios, from tail dependence. This article proposes the following reading: a diversified portfolio is also diverse in weaknesses and in strengths. What matters is that weaknesses do not synchronize under stress, and...

Strategic rebalance after the drop in the first week of February

Rebalancing in a correction: stop loss on GOOG (04/02/2026) and tactical rotation (orders 05/02/2026) Summary: In early February 2026, the portfolio faced a correction with high sensitivity to technology and growth: on 03/02 it recorded an intraday drop close to -1.8% and closed almost flat; on 04/02, with a monthly drawdown close to -4.8% MTD isn’t, a trailing stop loss on GOOG was triggered to...

How to spot a bad investor: clear red flags you should not ignore

How to spot a bad investor: certainty, narrative, and red flags you should not ignore The investor who tries to persuade others by displaying excessive certainty about a position or about the future necessarily falls into one of two categories: either an enthusiastic idiot who does not understand risk, or a fraudster who deliberately hides it. This kind of certainty is not a virtue, it...

Possible Impact of Maduro’s Capture on My Global Portfolio: Scenarios for January and the First Quarter

Possible Impact of Maduro’s Capture on My Global Portfolio: Scenarios for January and the First Quarter This article presents a tactical (January 2026) and medium-term (next 3 months) assessment of how the capture of Nicolás Maduro, together with the signal that the U.S. will “take control” during the transition, may transmit to a globally diversified portfolio. The analysis is structured by impact channels (risk-off, oil,...

2025 Annual Report for eToro Followers and Copiers

2025 Annual Report: Portfolio Results and Process Author: Giorgio Reveco Barraza Publication date: 01/01/2026 Period evaluated: 2025 Data source: 2025 annual/monthly panel and 1Y comparison (as of 01/01/2026) on the platform (screenshots/visible statistics) TABLE OF CONTENTS Executive summary Year performance Comparison with indexes Objective and operating philosophy Portfolio structure Implementation: simple, repeatable rules Risks and scenarios What to expect if you copy (and what not)...

Monte Carlo Simulation: My Management Projection February 2024 – October 2025

Monte Carlo Simulation: My Management Projection February 2024 – October 2025 Assess and be transparent At the close of a turbulent October, I ran a Monte Carlo Simulation to evaluate—using data—the quality of my management since I started investing with real capital on February 1, 2024. The observation window for this run ends on October 30, 2025. This exercise gives me an objective benchmark, the...

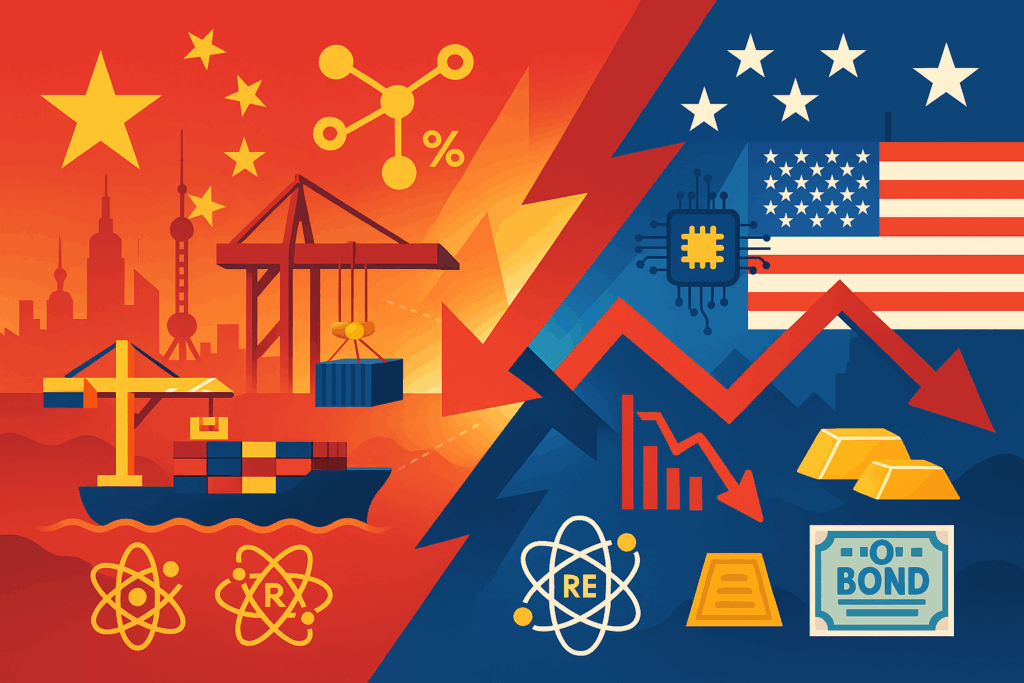

Global Market Impact: Rare Earths, Tariff Threat China vs U.S.

Global Market Impact: Rare Earths, Tariff Threat, and Asset-Class Effects China tightened export controls and licensing for products linked to rare earths, key inputs for electronics, electric vehicles, and defense systems. In response, the United States threatened new tariffs on Chinese imports. This combination heightened global risk premiums and triggered a flight to safety: accelerated selling in technology and semiconductors, weakness in companies dependent on...

$LSEG.L: Results, ASV, Microsoft partnership and tax advantage for dividends

$LSEG.L: Results, ASV, Microsoft partnership and tax advantage for dividends London Stock Exchange Group ($LSEG.L) is today much more than a stock market: it is a global platform of data, indices, and analytics serving banks, asset managers, and issuers in over 170 countries. In 2025, the stock suffered from headlines about the slowdown in Annual Subscription Value (ASV), despite interim profit growth and a business...

Charts Lie (Sometimes): Survivorship Bias in Investing

Charts Lie (Sometimes): Survivorship Bias in Investing The story told by those who survived Many “spectacular histories” show only the companies that survived, ignoring those that went bankrupt. That survivorship bias distorts returns and makes us believe that it is enough to pick the “winners.” The more sensible alternative is to design a portfolio that includes the winners without needing to guess them. What Graham...

UnitedHealth (UNH): Investment opportunity or value trap after the sharp drop?

UnitedHealth (UNH): Investment opportunity or value trap after the sharp drop? Introduction: the volatility of UnitedHealth and the search for opportunities So far in 2025, the shares of UnitedHealth Group (UNH) have ceased to be a defensive haven and have become one of the most volatile assets in the S&P 500 index. The stock of the health-care giant fell by around 50 % from its 2024 highs...